Donna GayleenKacy SallieTrude HorPippa Ferguson - Tax Bracket 2025 Married Filing Separately Single Liesa Krissy, Married couples filing jointly enjoy a tax status where they combine their incomes and file a single tax return. Tax Brackets 2025 Usa Married Filing Jointly Jessi Lucille, Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child.

Tax Bracket 2025 Married Filing Separately Single Liesa Krissy, Married couples filing jointly enjoy a tax status where they combine their incomes and file a single tax return.

Tax Bracket 2025 Married Filing Separately With Dependents Holly Laureen, Married couples filing separately and head of household filers;

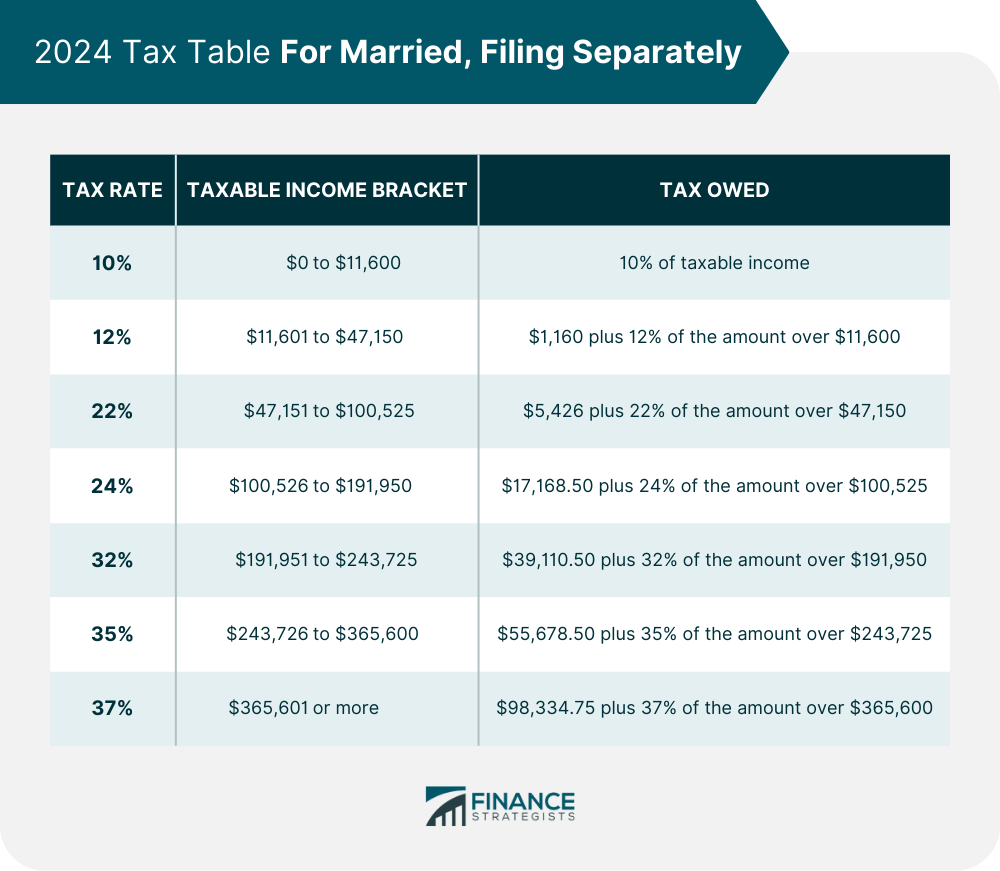

Tax Bracket 2025 Married Filing Separately With Dependents Holly Laureen, There are seven tax brackets for most ordinary income for the 2025 tax year:

2025 Tax Brackets Married Filing Separately. In order to file a joint tax return in 2025, you had to have been legally married by dec. The agency has boosted the income thresholds for each.

Tax Brackets Definition, Types, How They Work, 2025 Rates, For 2025, the irs made adjustments to federal income tax brackets to account for inflation, including raising the standard deduction to $14,600 (up from $13,850) for single filers.

2025 Tax Brackets Married Filing Separately Married Bria Marlyn, Below, cnbc select breaks down the updated tax brackets for 2025 and what you need to know about.

2025 Tax Brackets Announced What’s Different?, The federal income tax has seven tax rates in 2025:

Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married. Married filing jointly or married filing separately.

Tax Brackets Married Filing Jointly 2025 Hedda Guglielma, The highest earners fall into the 37% range, while those who earn the.

Us Tax Brackets 2025 Married Jointly Vs Separately Erena Josephine, Here are the steps to calculate the amount of tax to withhold:

2025 Tax Brackets Married Filing Separately Married Filing Carri Korrie, So as long as you got your marriage license in 2025, you were.